1c accounting 8.3 payment order. Payment order

Vladimir Ilyukov

Automatic creation of payment orders for the payment of taxes and contributions in 1C Accounting 8.3 is not fiction, it is reality. Gone are the days when it was necessary to set up payments for a long and tedious time. Constantly ensure that the CCC and payment details are correctly indicated in the payment.

New technologies have made it possible to automate the process of creating payments for taxes and contributions. A lot of users actively use it. But there are also those who, in the old fashioned way, continue to copy previously issued payments, then manually fill them in with up-to-date data. This is not always convenient and fraught with errors.

Payment orders in the 1C Accounting 8.3 program can be created in three ways.

- Manually.

- Automatically from the task list.

- Automatically from the journal "Payment Orders".

About the mechanism of automatic generation of payments in 1C 8.3

For the automatic generation of payment orders in 1C Accounting 8.3, almost nothing needs to be configured. You just need to understand how payments are formed.

Let's start with the guide "Taxes and Contributions": " Directories > Bank and cash desk > Taxes and contributions". If you open it in a clean infobase in which no organizations have been created yet, then only two taxes will be displayed in it.

The first thought that comes to mind is to use the "Create" button and describe in it all the necessary taxes and contributions. It's better not to. As necessary, the necessary taxes will be automatically updated in this directory.

What does as needed mean? You probably noticed that when you open a clean database, the program first offers to connect to 1C servers in order to get the latest update. Only after that the program offers to describe the organizations.

While creating new organization or individual entrepreneur the program automatically generates an accounting policy, as well as taxes and contributions that it must pay. This is done on the basis of the taxation system specified during the creation of the organization.

For example, let's create an organization LLC "OSN", that is, with common system taxation. On the this stage In the organization card, it is enough to indicate the name of the organization. The rest of the details are of no interest to us yet. And now let's open the directory "Taxes and contributions" again.

As you can see, taxes were automatically updated in it, which are mandatory paid by all taxpayers applying DOS.

What if, in addition to the specified taxes, the organization is obliged to pay other taxes? It was noted above that it is better not to create them manually. Everything is simple. Let's assume that our organization combines DOS with UTII and pays the Sales tax. Opening the form Main > Settings > Taxes and Contributions and set the appropriate flags.

After that, two more taxes are updated in the “Taxes and Contributions” directory: UTII and Trade Duty.

If you need to connect some more taxes, then in the "Taxes and reports settings" form, click on the link "All taxes and reports (14 more)". A list of additional taxes will open. The same list can be opened by clicking on the link "Setting up the list of taxes and reports" in the form "Main > Tasks > Task list".

You probably noticed that in the "Taxes and Contributions" directory, each element is automatically created with a completed CCC, an accounting account, and a template for assigning a payment.

To be sure that the correct BCC is set for a particular tax, it is enough to update the program on time. And for this, users of professional versions of 1C Enterprise programs are required to systematically subscribe to 1C ITS TECHNO or 1C ITS PROF.

In addition to tax data, the payment order must contain the so-called payment details. These are the bank details of the respective tax administrators.

We believe that we have a 1C Counterparty service. Then, in the card details of the organization, in the appropriate fields, indicate the code of the controlling body and click on the button "Fill in the details by code." As a result, the 1C Counterparty service will automatically fill in the payment details of the regulatory authorities.

Their completion is evidenced by the appearance of links against the inscriptions "Payment details". To make sure that the details for the payment order are formed correctly, click, for example, on the link "Federal Treasury Department ..." and check if this is the case.

Now everything is ready for processing payment orders. Consider automatic ways formation of payments in 1C.

Creating payment orders in 1C Accounting 8.3 from the list of tasks

Open the form "Main > Tasks > List of tasks". In it, the system reminds the user about the deadlines for paying taxes, contributions and the deadlines for submitting regulated reports. But it's not just a list of reminders. Here you can also create payment orders for the payment of taxes and contributions, as well as generate regulated reports.

We are interested in payments. Let's pay attention to the fact that " Insurance premiums, payment for February" were overdue for some reason. Let's click on this link. The form "Insurance premiums, payment for February 2017" will open.

In this form, in the "Calculation of the amount" section, all insurance amounts are displayed that the organization "Expenses on labor costs" would have to pay for February. The presence of this section indicates that the salary and insurance premiums for February were accrued. However, insurance premiums have not yet been paid.

In order to minimize the increase in penalties for late payment, you can "Request reconciliation with the Federal Tax Service." This pleasure can be afforded by those users who have the service connected. 1C-Reporting.

To create payments in 1C for the payment of insurance premiums, click on the "Pay" button. As a result, this form will take the form.

By the way, if the salary had not been accrued, then the button “Calculate salary and contributions” would have been displayed instead of the “Calculate the amount” section.

Of course, in order to calculate salaries and insurance premiums, there is no need to go to the “Salary and personnel” section of the main menu. This can be done by clicking on the Calculate Payroll and Contributions button on the April 2017 Insurance Contributions payment form.

Let's return to the list of tasks for the organization LLC " Wholesale"And click on the link" USN, advance payment for the 1st quarter of 2017.

This form clearly displays the calculation of the advance payment. Click on the link "Payment order 6 dated 04/10/2017". A payment form will open, check it and carry it out.

Thus, we create payments for all taxes and contributions that the organization is obliged to pay.

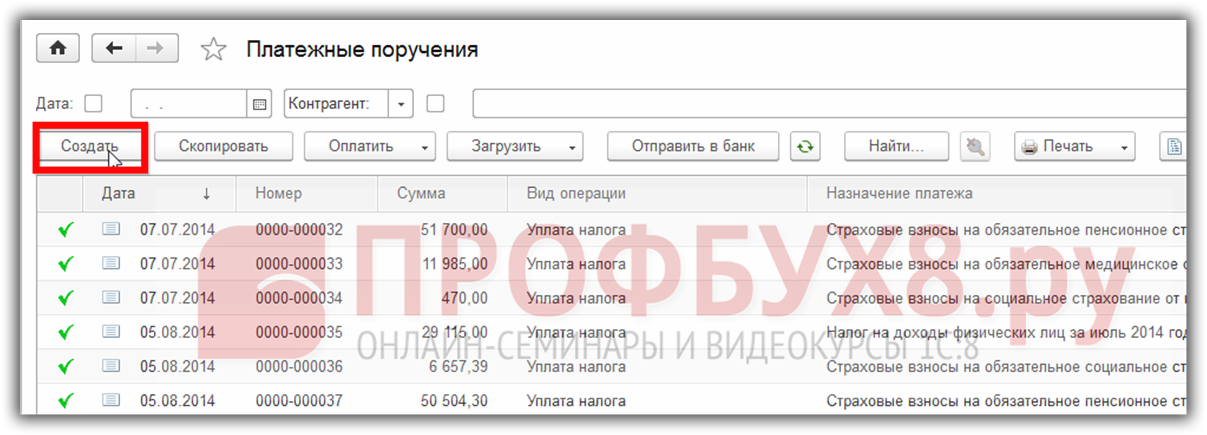

Creation of payments in 1C 8.3 in the journal of payment orders

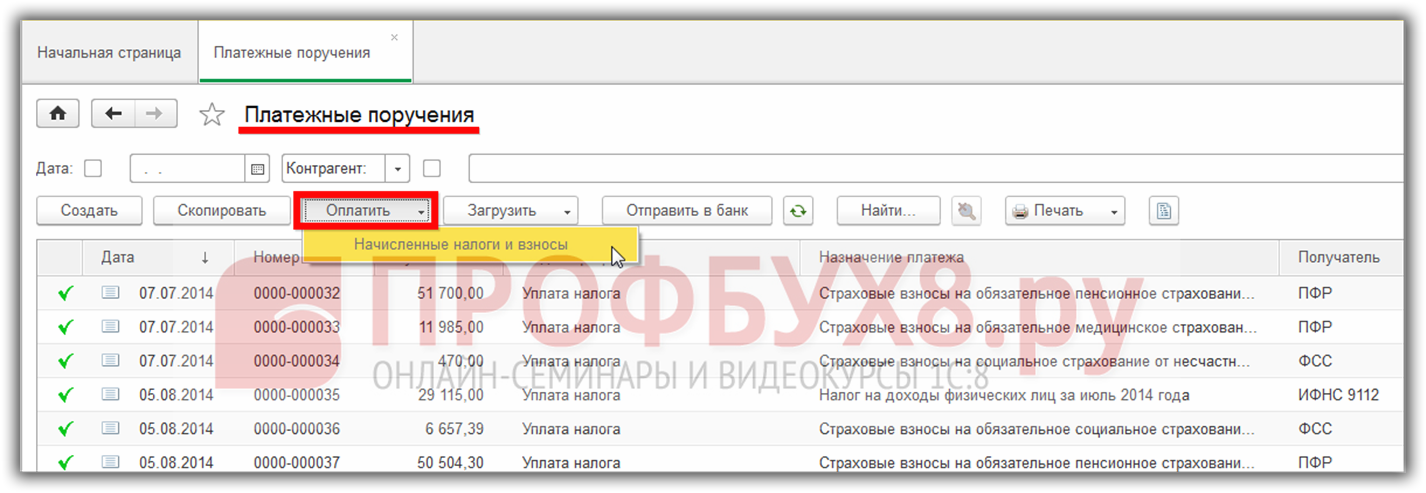

Let's open the payment journal: "Main > Bank > Payment orders".

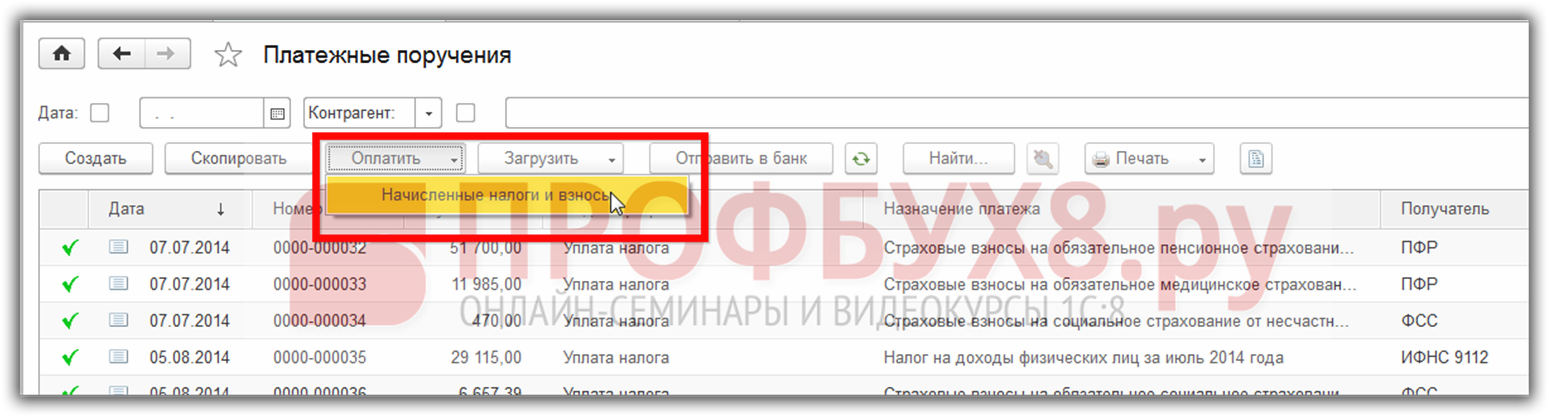

In the header of the magazine, press and the button " Pay > Accrued taxes and contributions». The auxiliary form "Accrued taxes and contributions" will open.

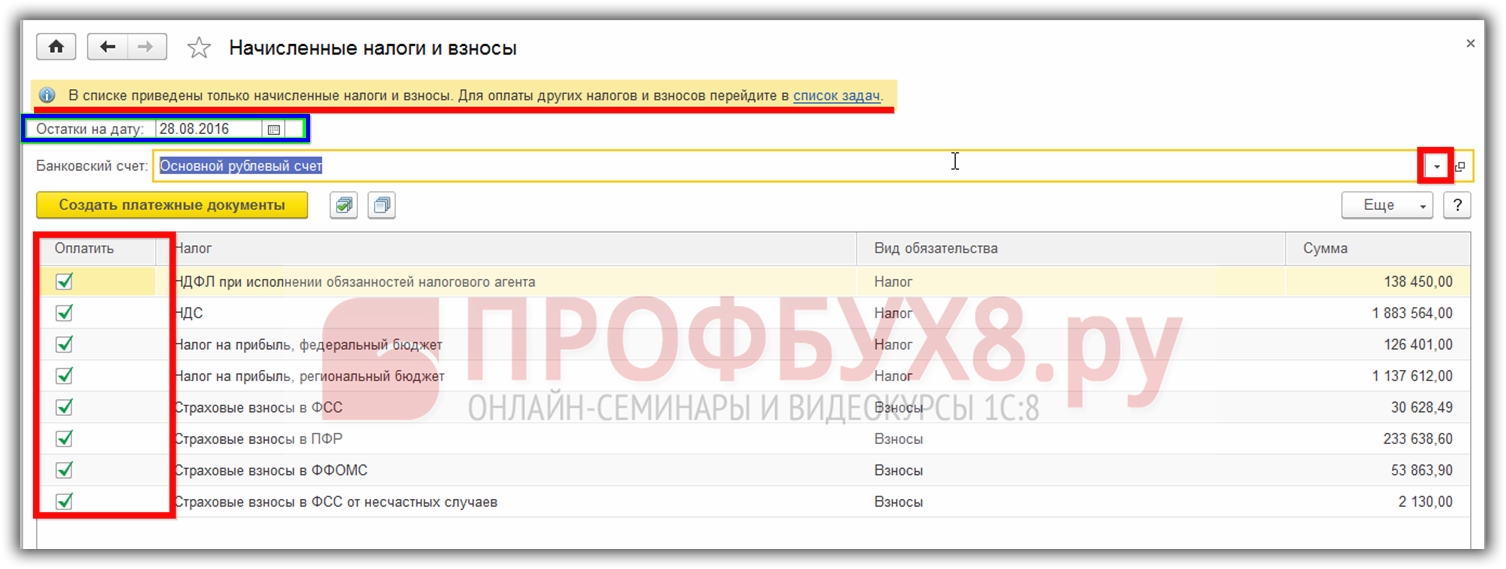

In its tabular part, all accrued taxes and contributions that the organization is obliged to pay are listed. It is important to keep in mind that only those taxes and contributions that were accrued in the program are displayed here. We also recall the inscription located immediately below the name of the form: “The list shows only accrued taxes and contributions. To pay other taxes and contributions, go to the task list.

Clicking on the "Create payment documents" button will lead to the creation of payments for the taxes and contributions marked in the tabular part.

Conclusion

It is possible that someone will ask which method of creating payments for paying taxes and contributions is better to use in the 1C Accounting 8.3 program. It is impossible to give a definite answer: both methods are good. True, in a particular situation, the following features should influence the choice of method.

- Formation of payments in 1C from the list of tasks. This method is very good in cases where the user does not remember the dates of payment of taxes and contributions. When using this method, each click creates payment orders to separate view tax or group of taxes. In the example discussed above, this is a group of payments for the payment of insurance premiums. In other cases, everything is separate: Income tax, VAT, property tax, etc.

- Formation of payments in 1C from the journal of payment orders. When using this method, the system does not control the timing of payment of taxes and contributions. But it allows you to create payment orders immediately for all accrued taxes and contributions.

Payment order- an order from the organization to the bank to transfer the appropriate amount from its current account to the recipient's current account. The paying organization submits an order to the bank on the form of the established form.

Orders are valid for ten days from the date of issue (the day of issue is not taken into account).

To issue a payment order in a standard configuration, a document is intended "Payment order". To enter a new document, select the item "Payment order" from the menu "The documents" main menu of the program.

The composition of the details in the form of a document dialog can be different, depending on whether the document is a transfer of a tax payment or another transfer, for example, payment to a supplier for goods received from him.

The document form must be completed in the following order:

- Select the account from which the funds will be transferred. By default, the document uses the current account that was selected as the main one when filling in the basic information about the organization. If you want to make a transfer from the second (third, etc.) current account, then you need to click on the select button and select an account from the directory "Bank accounts".

- If you are making a payment to transfer taxes or insurance premiums, you must check the box "Payment of taxes".

- Specify the number of the payment order. By default, payment orders are numbered automatically in ascending order of payment orders issued using this document.

- Select the date of the payment order using the calendar. By default, a payment order is issued with the date set in "1C: Accounting" as a working date.

- "Contractors" props "Recipient". If the recipient is not in the directory, you can enter information about him in the directory directly in the process of issuing a payment order.

- The props "Beneficiary Account" when choosing a counterparty, an invoice is automatically entered, standing first in the list of settlement accounts of the counterparty in the directory "Settlement accounts". If you need to specify another current account, press the key F4 and select from the directory "Settlement accounts", according to what bank details send money. Directory "Settlement accounts" subordinated to the directory "Contractors", therefore, in the selection window that opens, only those current accounts that relate to a specific recipient are shown.

- Fill in with a choice from the directory "Contracts" on what basis the transfer is made. If there is no basis in the directory, you can enter information about it in the directory directly in the process of issuing a payment order. This attribute is not required, but its value will be used when filling out the document "Extract".

- The checkpoint of the payer and the recipient must be indicated in the payment order only when making a tax payment. Some banks may require an indication of the payer's KPP and/or the payee's KPP in the case of a non-tax payment, in which case it is necessary to fill in the details "Payer Checkpoint" and/or "Recipient Checkpoint".

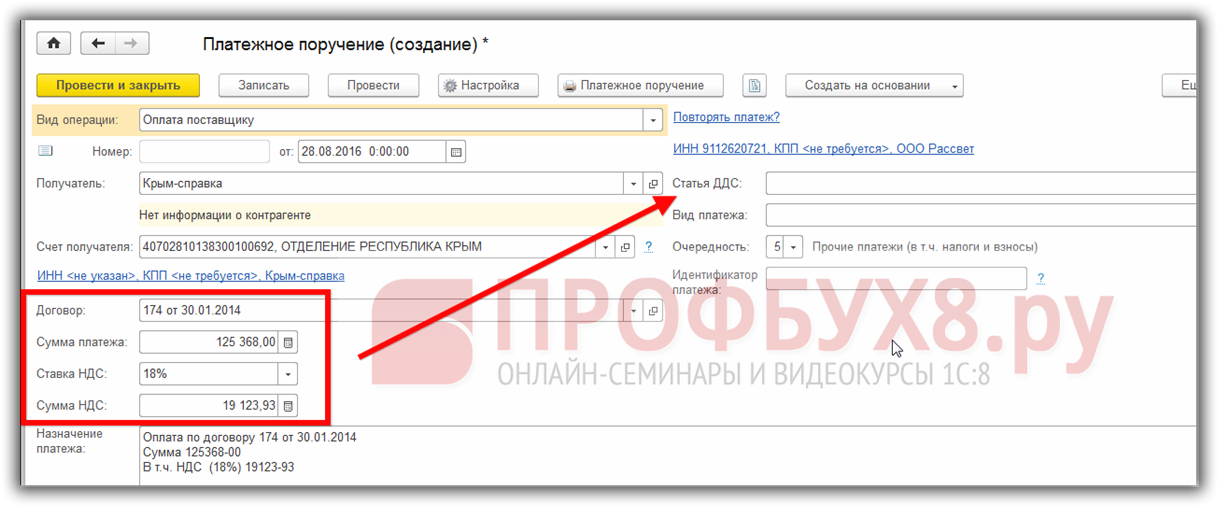

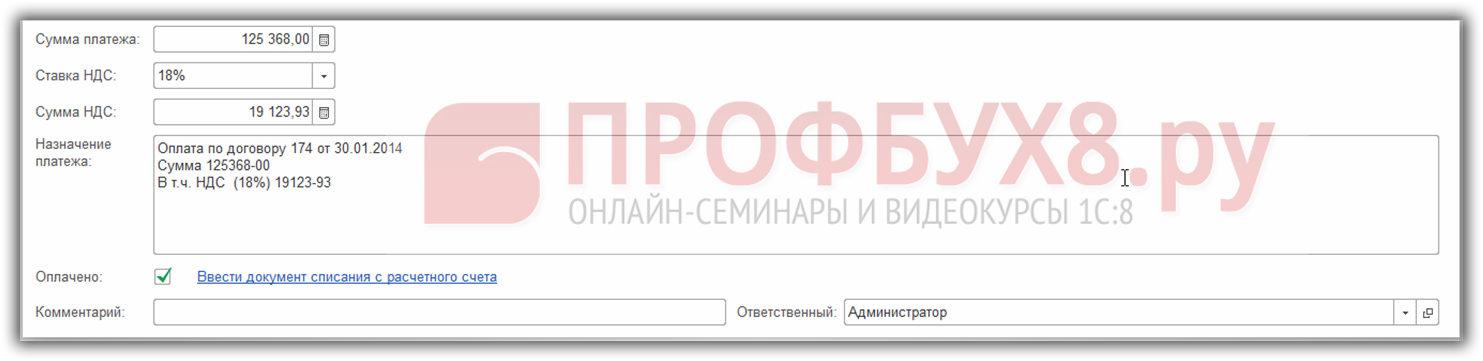

- Specify the amount to be transferred (details "Sum").

- If you are paying for inventory items, works and services that are subject to value added tax, you must specify either the tax rate (details "VAT rate"), or enter the tax amount (details "VAT"). For payments without VAT (taxes, fees, interest on a loan, repayment of loans and borrowings, etc.), these details must be equal to zero.

- Specify the purpose of the payment (details "Purpose of payment"). If for the selected current account in the directory "Settlement accounts" the text for substitution in the field "purpose of payment" is specified, details "Purpose of payment" will be filled in automatically, but you can edit it if necessary.

- Select the type of payment: post, telegraph, e-mail. If the payment is made within the same settlement and cash center, the details are not filled. To clear the props, press the button "X" located to the right of the input field.

- In accordance with the Regulations on non-cash payments in Russian Federation, the payment term in payment orders is not filled in before the instructions of the Bank of Russia.

- In props "Priority of payment" indicate the group number of priority of payment, in accordance with Article 855 Civil Code RF.

- Select the substitution option in the purpose of payment for the payment amount and VAT.

After filling in the input form, you need to generate and print a payment order (button "Seal"), and save the document (button "OK").

Method 1. Filling out a payment order manually

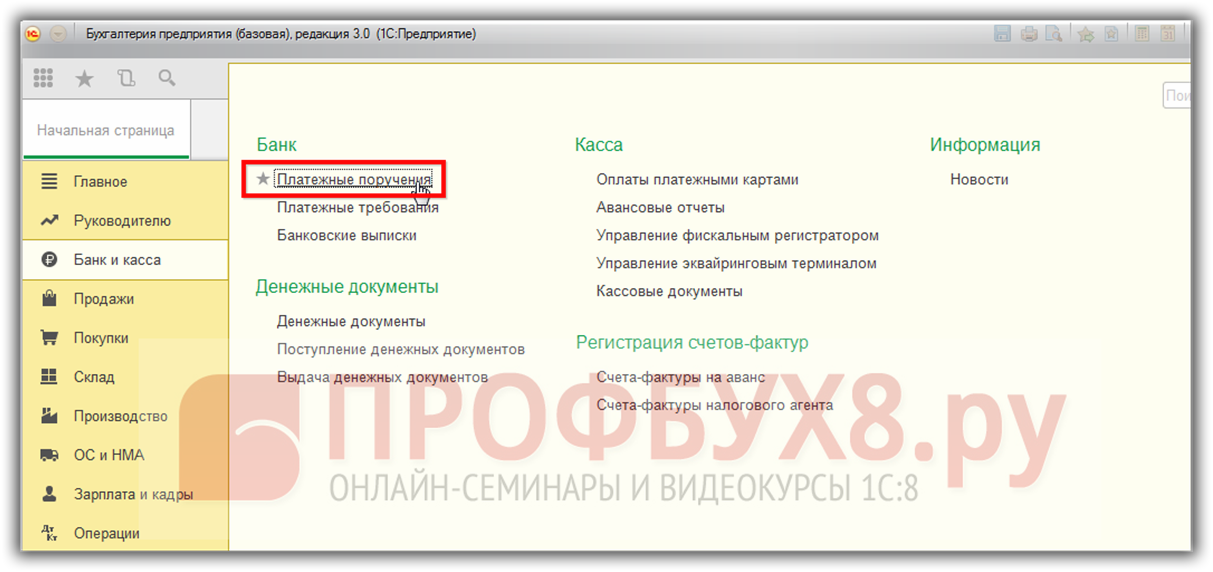

To do this, you need the section Bank and cash desk:

After that, in the navigation, select Payment orders:

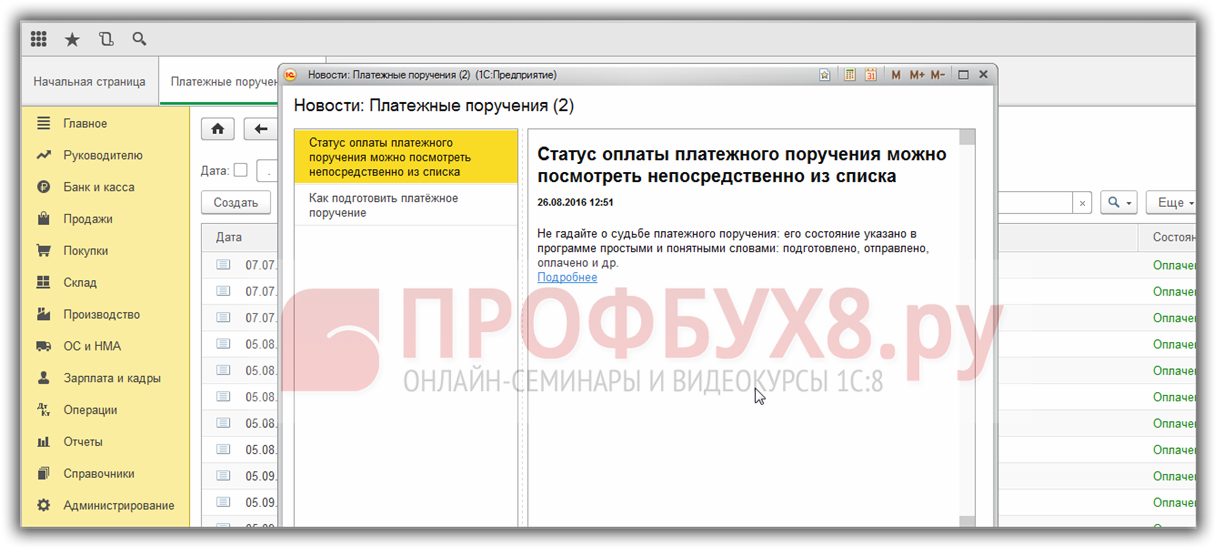

When you first go to this section, the 1C 8.3 program opens an information window with hints "How to create a payment order":

If you no longer want to see the information window with hints, then click the Don't show again button.

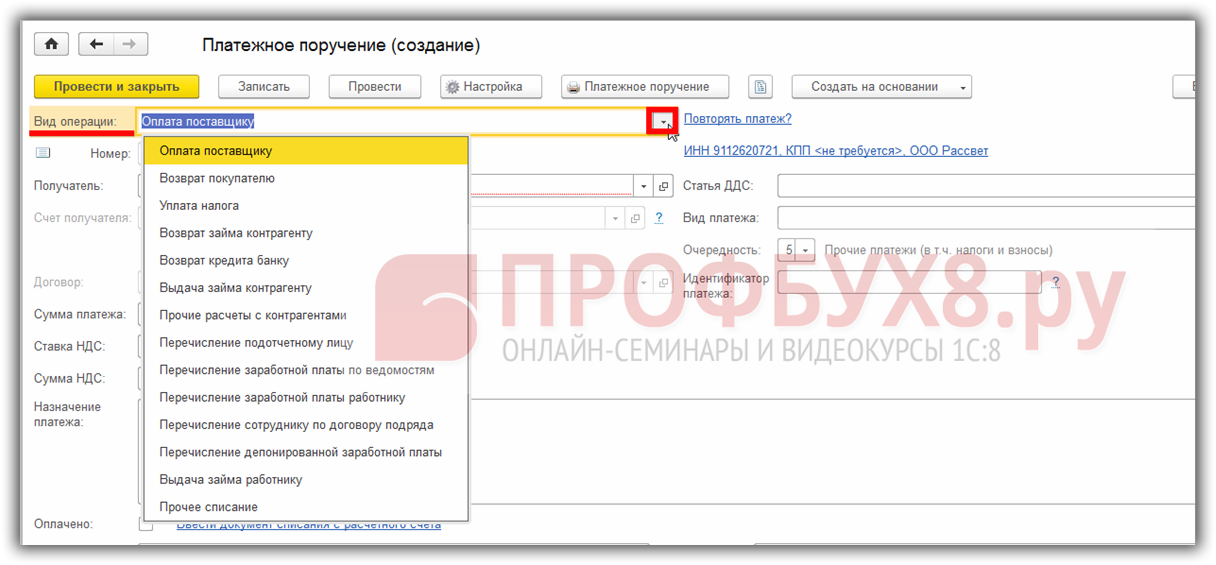

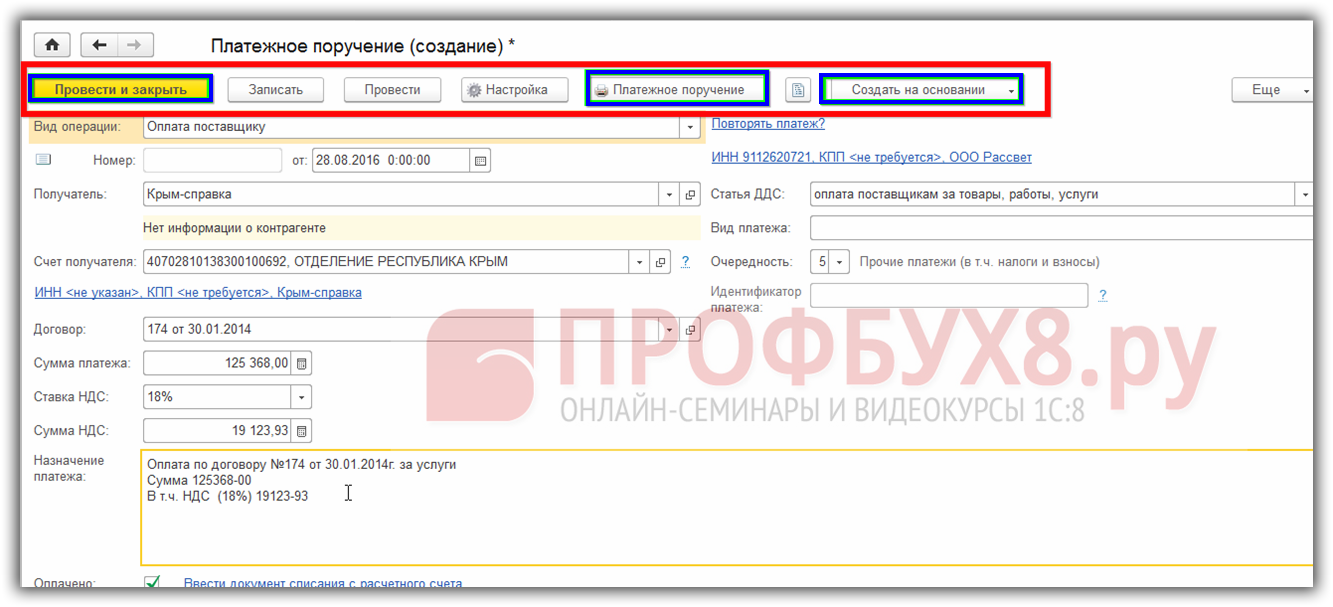

In the window that opens for creating a payment order, the first thing you need to decide is the Type of operation:

Consider filling out a payment order using the example of payment to a supplier.

Attention! The number of outgoing documents is affixed by the 1C 8.3 program automatically when recording or posting a document.

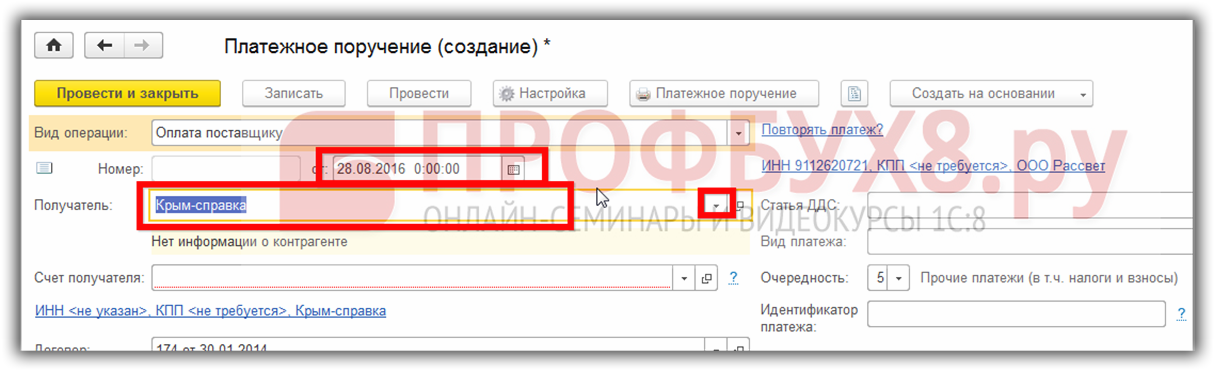

After selecting the type of operation, you must set the desired date of the payment order and select the supplier to whom payment is made:

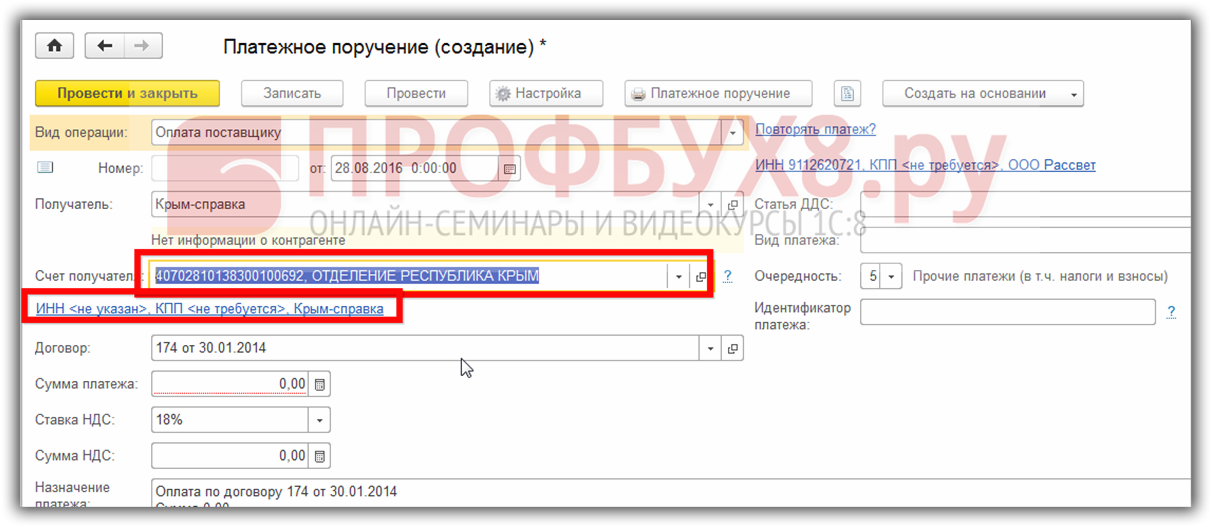

Next, you need to enter the recipient's bank account - this is a mandatory requisite, in contrast to the document Withdrawal from the current account. Please note that under the Recipient's Account attribute, the 1C 8.3 program warns what information about the counterparty is missing in the supplier's card:

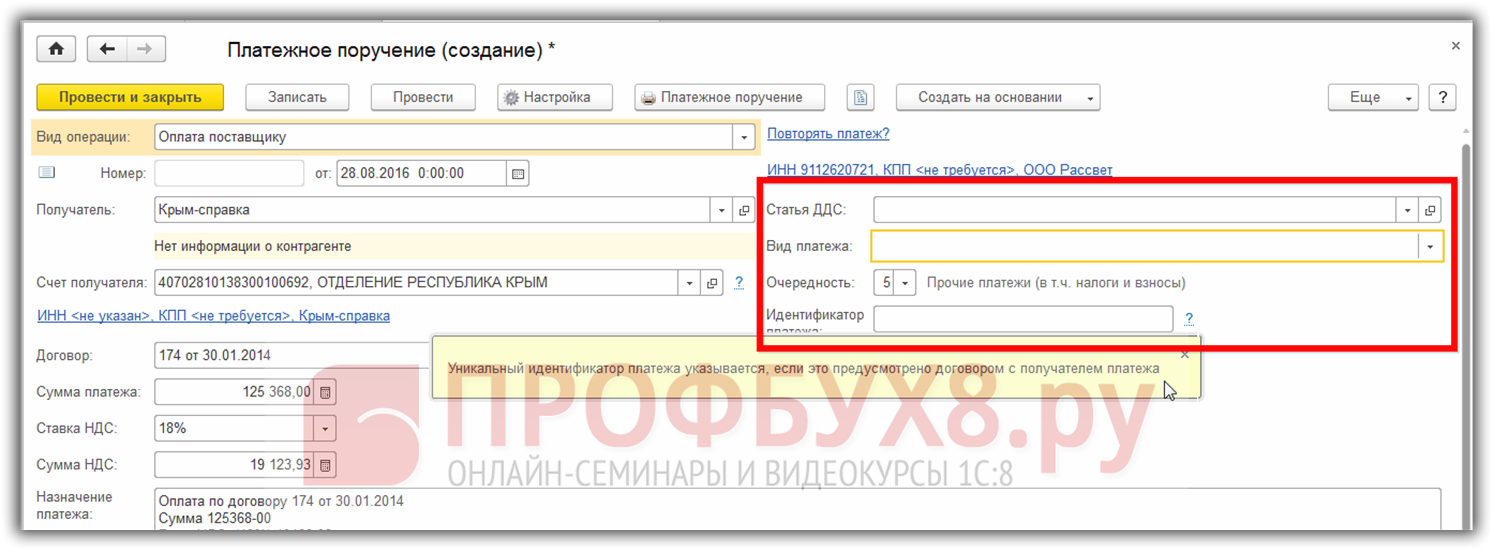

After that, we proceed to filling in the details located on the right side of the screen:

- Filling out the movement article Money if records are kept according to the items of movement;

- Type of payment - how the money is transferred, not a mandatory requisite;

- order of payment;

- Unique payment identifier - if it is provided by the agreement with the recipient:

After that there is an option:

- Correct the purpose of the payment, indicate whether the money is really transferred or not; Enter the document Write-off from the current account on the basis of this payment order;

- You can also fill in the Comment and Responsible fields:

After filling in all the necessary fields of the document to save it or print it, 1C 8.3 has special buttons at the top of the document:

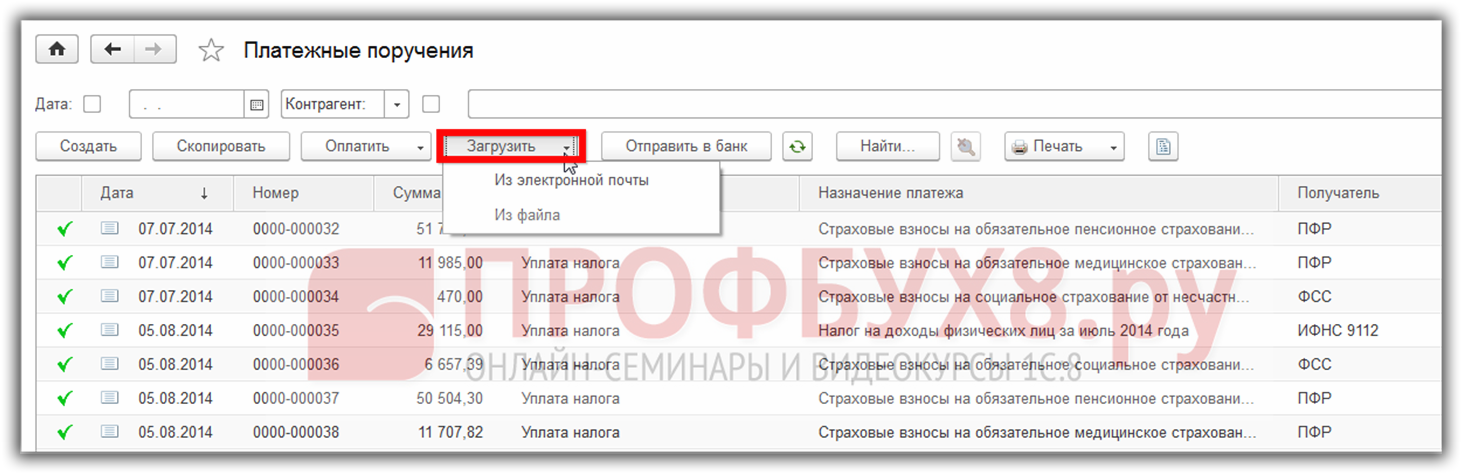

Method 2. How to generate a payment order from email or from a file

In addition to the above method in 1C 8.3, it is possible to download payment orders from Email or from a file:

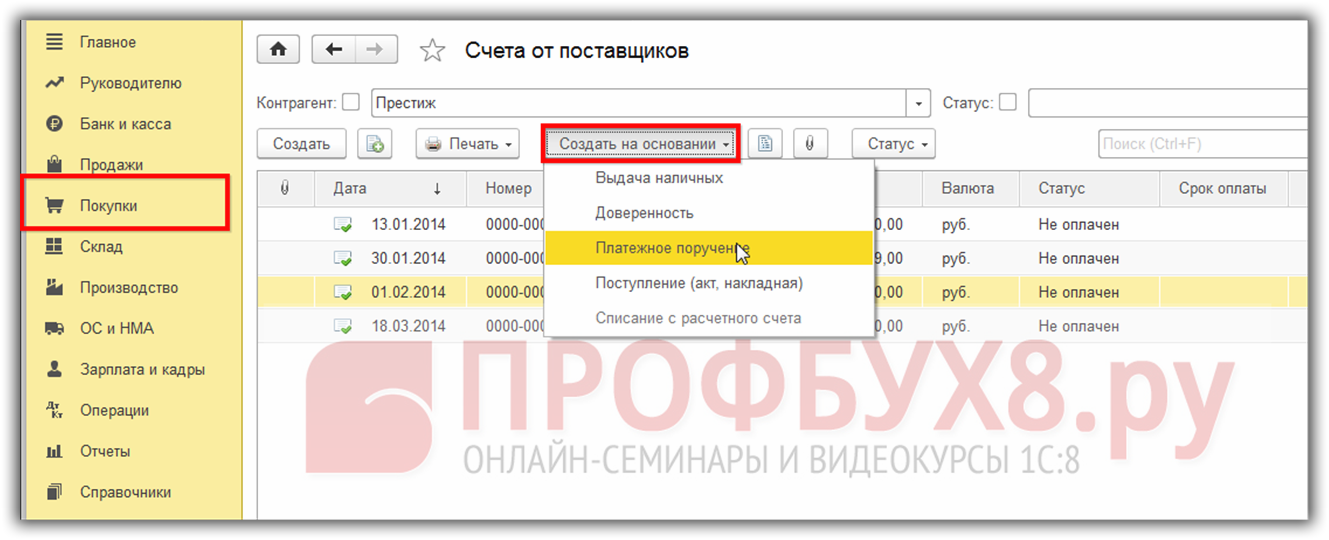

Method 3. Creating payment orders based on other documents

Another way to create a payment order in 1C 8.3 is to create it “based on” other documents. For example, Invoices:

Method 4. Formation of payment orders for taxes and contributions

In addition, in 1C 8.3 in the register of Payment Orders there is an interesting Pay service:

The 1C 8.3 program allows, provided that the payment details of the authorities are filled in, to generate payment orders for paying taxes and contributions with the balance of the debt on a certain date:

In the window that opens, you must select the date of the balances, according to which the 1C 8.3 program:

- Fill out payment orders. Settlement account from which payment is made and the details of which will be reflected in the payment order;

- And also tick off those taxes and contributions that need to be paid:

One of the most important tasks of an accountant is not to miss the deadlines for paying taxes. For this, the 1C 8.3 Accounting Taxi interface provides an accountant calendar. This service automatically displays a notification 5 days before the due date and allows you to generate a tax payment. See our video for more on this:

Rate this article:

The Payment order document in 1C Accounting 8.2 is used to generate a printed form of a payment order for a bank to transfer non-cash funds and save the payment order document in the information base.

The fundamental difference between the payment order document in 1C 8.2 and the previous version 8.1 is that in 1C 8.2 the “Payment order” and “Payment request” documents do not form accounting entries after posting these documents. The main purpose of the payment order document in 1C 8.2 is now to print a payment form for a bank or upload a payment order to an external client-bank program if any electronic payment system is used ....

All accounting entries in 1C Accounting 8.2 are formed by the document "Bank statements" both on receipt of funds to the current account and on write-offs.

To generate a payment order in 1C Accounting 8, you need to open the menu Bank - Payment order and add new document for filling.

Filling the placards does not cause any problems. Now the type of payment transaction is not even requested, since the document will not generate any movements.

In the form of a payment document, the details of the new document are filled in. For the organization, a bank account is selected, of which the organization can have many in different banks and different currencies.

Next, the recipient is selected from and the recipient's account, of which there are also several possible. The requisite "agreement" has become optional in the payment order, since the agreement is not used in the form of a payment order. But it is better to fill out the contract, because on the basis of the payment order document in 1C 8.2, it is possible to generate a bank statement document with automatic filling in the details, and there it is already necessary to fill in the “counterparty agreement” field.

The currency of the settlement amount is determined by the currency of the organization's current account in the "Bank account" selection field. The 1C payment itself does not select the currency of the operation, but automatically receives it from the details of the selected current account.

The flag of the document "paid" is set after the actual execution of the payment by the bank and is necessary for the selection of paid payment orders in the bank statement document.

Filling out a payment order for paying taxes and other transfers to the budget deserves special attention. For budget payments, the checkbox "transfer to the budget" is enabled. By clicking the "Fill" button, a directory of payments to the budget opens, and in the absence of the required tax, we add here the new kind tax payment. The completed details of budget payments can be used for subsequent payments of this tax, which greatly facilitates the subsequent processing of tax payments and other transfers to the budget.

The only thing to care about is to check the relevance, because they have the property to change sometimes.

Obviously, the “Incoming Payment Order” documents in 1C 8.2 are no longer needed (as it was in 1C 8.1), since payment transactions are not generated, and the payment order is filled out by the payer of the funds, and not the recipient.

The lesson "Filling out a payment order" can be downloaded at, and a sample payment order - in Excel format - from the link after the article. Samples of payment orders contain fictitious details, the open format of documents allows you to change the sample for real payments.

- Burns, Robert - short biography

- The concept of common vocabulary and vocabulary of limited use

- Nancy Drew: The Captive Curse Walkthrough Nancy Drew Curse of Blackmoore Manor Walkthrough

- Deadpool - Troubleshooting

- Won't start How to Survive?

- What to do if bioshock infinite won't start

- Walkthrough Nancy Drew: Alibi in Ashes

- Spec Ops: The Line - game review, review Spec ops the line crashes on missions

- Room escape level 1 walkthrough

- Processing tomatoes with boric acid How much will 2 grams of boric acid

- Cucumber Grass (Borago)

- Bioinsecticide Lepidocid: purpose, properties and application procedure Lepidocide waiting period

- How to change the language to Russian in steam

- Dendrobium noble: room care

- Morphology of plants general concepts - document

- Planting, propagation and care of bamboo at home, photo Growing bamboo from seeds

- How to strengthen the cellular signal for the Internet in the country

- Sanskrit reveals the forgotten meaning of Russian words (2 photos)

- The oldest language Sanskrit programming language of the future Dead language Sanskrit

- Who has dominion over all the earth?